What is Sensex and Nifty?

Dear friends here is our first non technical (per say) article by our guest contributor Mr. Ankur Jindal.

Sensex and Nifty are indexes of BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). So before we start, we have to learn that what the “Index” is. Index is an indicator, which indicate the Economical growth of the companies which are top in their sectors. Index are based on the average of the market capitalization of the companies.

Sensex

The Sensex is the benchmark index of the Bombay Stock Exchange often regarded as the pulse of the domestic stock market India. It indicates the RELATIVE PRICE of share listed on the Bombay Stock Exchange which means when the Sensex goes up it indicates that the price of the stocks of most of the major companies on the BSE have gone up. The base year of Sensex is 1978-1979 and the base value being 100. Now this question comes to our minds that what is base year and base value. The base year is the year against which the performance of the index is measured. For the ease of calculation, the base index value or the true value of the shares of the market at the time of index construction is assumed to be 100 in terms of point. Sensex is the average of market capitalization of 30 companies.

Nifty

The Nifty is the benchmark index of the NSE (National Stock Exchange). It indicates the RELATIVE PRICE of shares listed on the National Stock Exchange which means when the Nifty goes up it indicates that the price of the stocks of most of the major companies on the NSE have gone up. The base year of Nifty is 1995 and the base value is 1000. In short, Nifty is the average of market capitalization of 50 companies which are not constant. I mean companies changes according to the performance of the companies

Sensex vs Nifty

How the Sensex is calculated

We assume that company A has 100,000 shares outstanding and B has 200,000 shares outstanding. Hence, the total market capitalization is (200 x 100000 + 150 x 200000) Rs 500 lakhs. This will be equivalent to 100 points.

Lets assume that tomorrow, the price of A hits 260 (30% increase in price) and the price of B hits 135. (10% drop in price). The market capitalization will have to be reworked. It would be – 260 x 100,000 + 135 x 200,000 = 530 lakhs. That means, due to the changes in price, the market capitalization has moved from 500 lakhs to 530 indicating a 6% increase. Hence, the index would move from 100 to 106 to indicate the net effect.

This logic is extended to many selected stocks and this calculation process is done every minute and that’s how the index moves.

What we said was the general method to construct indices. Since, the Sensex consists of 30 large companies and since it’s shares may be held by the government or promoters etc, for the purpose of calculating market capitalization only the free float market value is considered, instead of the total number of shares.

Example

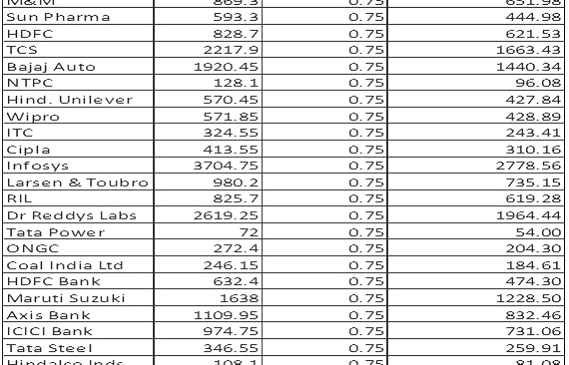

We have assume Free float 75% for each company i.e. 25% share held by founder(s), director(s), promoter(s) etc.

The formula to calculate the Sensex is as follows:

(Sum of Free Float Market Capitalization / Base Market Capital ) x 100

Given:

- Sum of Free Float Market Capital = 20148.90

- Base period of Sensex is 1978-79 = 100 (as discussed above)

So from 20148.90*100/100, we get value = 20148.90 Sensex points.

Nifty Calculation

NIFTY was coined fro the two words ‘National’ and ‘FIFTY’. The word fifty is used because; the index consists of 50 actively traded stocks from various sectors.

the Nifty is a market capitalization weighted index also based on the Free Float Method. They involve the total market capitalization of the companies weighted by their effect on the index, so the larger stocks would make more of a difference to the index as compared to a smaller market cap company.

Nifty is calculated using the same methodology adopted by the BSE in calculating the Sensex – but with three differences, which are:

- The base year is taken as 1995

- The base value is set to 1000

- Nifty is calculated on 50 stocks actively traded in the NSE

- 50 top stocks are selected from 24 sectors.

tnku sir…u make this thing so easy 2 understand

We are glad that you liked it!

Nice to see some good stuff of non technical nature presented with such a simple and effective way.

Thanks for the post!